is mileage taxable in california

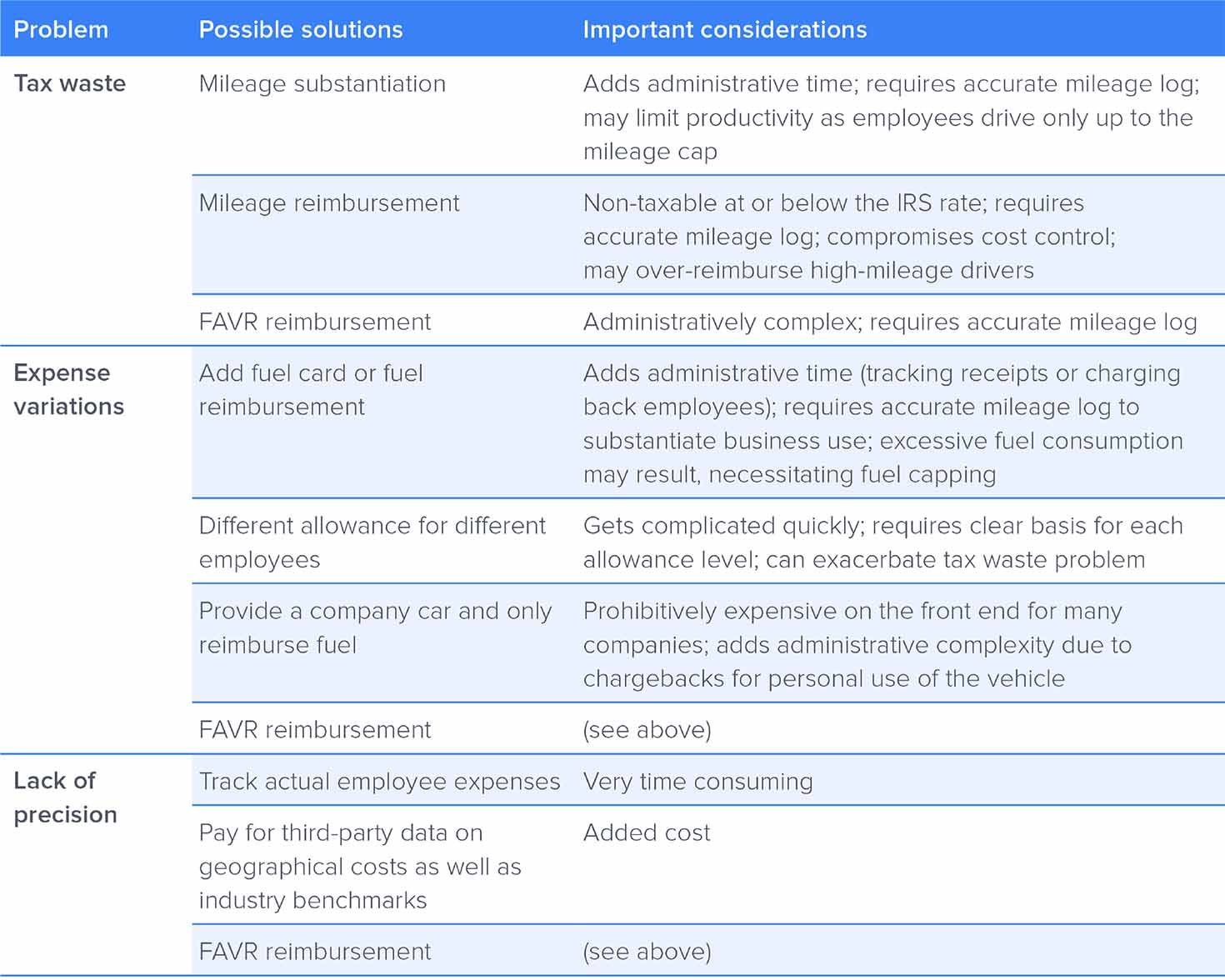

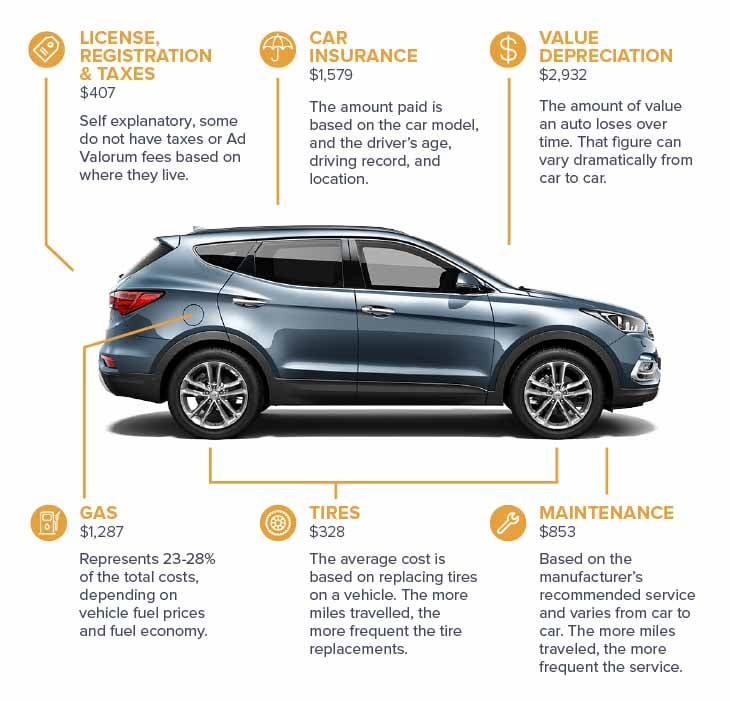

The type of reimbursement plan will dictate whether reimbursement for business travel is or is not taxable. How do I calculate mileage reimbursement in California.

California Mileage Reimbursement How Does It Work

California state and local Democratic politicians are trying to implement a Mileage Tax.

. California isnt alone many states are facing infrastructure issues and not enough funding from traditional gasoline taxes. Get ready for a costly new Mileage Tax on top of what you already pay at the pump. The most common travel expense is mileage.

In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. Online videos and Live Webinars are available in lieu of.

You may also be able to claim a tax deduction for mileage in a few other. You dont necessarily have to reimburse employees at that rate but paying a different. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

To compute your mileage reimbursement multiply the applicable mileage rate by the number of miles driven. And the California Labor Commissioner has taken the. For these employees the tax cuts amounted.

Employees will receive 575 cents per mile driven for business use the previous rate in. Employees who receive a car allowance were accustomed to being able to write off their business mileage every tax season until the spring of 2019. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

Arguments for mileage tax. When an employer reimburses at. California mileage reimbursement law.

The new rate for. California Mileage Reimbursement Frequently Asked Questions. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

The main arguments for a mileage tax. The IRS rate for 2022 was set at 0585 per mile in December 2021 but. Please contact the local office nearest you.

The standard mileage rate changes every year but for 2021 it stands at 56 cents per mile. Both accountable plans and non. Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be.

Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate 0625mile for. What transactions are generally subject to sales tax in California. What Is the IRS Mileage Rate for 2022.

585 cents per mile driven for business use up 25 cents from. Most employers reimburse mileage at the IRSs mileage reimbursement rate. The answer is it depends.

Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. For questions about filing extensions tax relief and more call. The short answer is yes mileage reimbursement is taxable if the reimbursement rate exceeds the IRS rateset at 625 cents per mile for 2022.

California requires that a sales tax be collected on all personal property that is being sold to the end consumer for storage. Mileage reimbursement is generally non-taxable if it does not exceed the IRSs mileage reimbursement rule which is 56 cents per mile. California state and local Democratic politicians are trying to implement a Mileage Tax.

What Are The Mileage Deduction Rules H R Block

Irs Mileage Reimbursement 2022 Everything You Need To Know About

Is A Mileage Reimbursement Taxable

What Is Company Car Allowance How Does It Work

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Your Guide To California Mileage Reimbursement Laws 2020

Is Mileage Reimbursement Taxable Income

![]()

Is Mileage Reimbursement Taxable Income

Is A Mileage Reimbursement Taxable

California Labor Code 2802 What Expenses Get Reimbursed

Mileage Reimbursement A Complete Guide Travelperk

2022 Everything You Need To Know About Car Allowances

2022 Everything You Need To Know About Car Allowances

Irs Mileage Reimbursement 2022 Everything You Need To Know About

2022 Everything You Need To Know About Car Allowances

Your Guide To California Mileage Reimbursement Laws 2020

The Current Irs Mileage Rate See What Mileage Rates For This Year